7

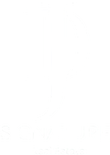

New Full Irvine, CA Market Update for Buyers and Sellers. Available now on my YouTube Channel! Link in Bio!!! Let me know what you think!!!

#jdsignaturere #bkplatinumproperties #ocrealtor #IrvineRealtor #irvine

7

New Full Irvine, CA Market Update for Buyers and Sellers. Available now on my YouTube Channel! Link in Bio!!! Let me know what you think!!!

#jdsignaturere #bkplatinumproperties #ocrealtor #IrvineRealtor #irvine

17

If you’re researching how much it really costs to buy a home in Irvine CA in 2026… the price is only part of the story.

Most buyers calculate the mortgage — but forget about:

• Property taxes (1.1%–1.35% in many neighborhoods)

• Mello-Roos in communities like Great Park & Portola Springs

• HOA fees that can range fro…

17

If you’re researching how much it really costs to buy a home in Irvine CA in 2026… the price is only part of the story.

Most buyers calculate the mortgage — but forget about:

• Property taxes (1.1%–1.35% in many neighborhoods)

• Mello-Roos in communities like Great Park & Portola Springs

• HOA fees that can range fro…

1

1

📊 Irvine real estate prices are up ~60% since 2021 — but most sellers are still leaving money on the table. Here's why.

The headlines say Irvine is booming. The data tells a more complicated story.

→ Median prices hit $1.55M in 2025 → 78.5% of listings cut their price before selling → Days on market jumped from 14 → …

1

1

📊 Irvine real estate prices are up ~60% since 2021 — but most sellers are still leaving money on the table. Here's why.

The headlines say Irvine is booming. The data tells a more complicated story.

→ Median prices hit $1.55M in 2025 → 78.5% of listings cut their price before selling → Days on market jumped from 14 → …

10

Irvine CA real estate update for 2026 👇

The market isn’t crashing.

Median prices are still in the mid-$1.5M range. Homes aren’t moving at 2021 speed, but if they’re priced right, they’re selling.

This is a strategy market.

If you’re buying in Irvine, selling in Irvine, or relocating to Irvine, California, you canno…

10

Irvine CA real estate update for 2026 👇

The market isn’t crashing.

Median prices are still in the mid-$1.5M range. Homes aren’t moving at 2021 speed, but if they’re priced right, they’re selling.

This is a strategy market.

If you’re buying in Irvine, selling in Irvine, or relocating to Irvine, California, you canno…

8

1

Buying your first home in Irvine or Orange County doesn’t have to mean waiting years or overextending yourself.

For a lot of first-time buyers, townhomes are a smarter way to get into homeownership — lower prices, less maintenance, great locations, and the chance to start building equity instead of paying rent.

If yo…

8

1

Buying your first home in Irvine or Orange County doesn’t have to mean waiting years or overextending yourself.

For a lot of first-time buyers, townhomes are a smarter way to get into homeownership — lower prices, less maintenance, great locations, and the chance to start building equity instead of paying rent.

If yo…

1

The market is starting to shift in favor of buyers. More than one-third of sellers are now offering concessions, so if you've been waiting for a market correction, now could be the time to purchase your dream home! Reach out today to learn what options may be available!

#rmsma #realestestate #realestatemarket #sellers…

1

The market is starting to shift in favor of buyers. More than one-third of sellers are now offering concessions, so if you've been waiting for a market correction, now could be the time to purchase your dream home! Reach out today to learn what options may be available!

#rmsma #realestestate #realestatemarket #sellers…

3

Buyers often form their first impression of a home based on the online listing, so professional photos are essential. While you may be equipped to tackle the task yourself, hiring an expert to take well-lit, high-quality images will ensure that you highlight your home’s best features to attract more potential buyers.

…

3

Buyers often form their first impression of a home based on the online listing, so professional photos are essential. While you may be equipped to tackle the task yourself, hiring an expert to take well-lit, high-quality images will ensure that you highlight your home’s best features to attract more potential buyers.

…

1

Don't forget to ask your real estate agent these questions before listing your home!

#realestatereels #homeselling #homesellingtips #realestatetips #homesellingprocess #rmsma #JDSignatureRE #BKPlatinumProperties

1

Don't forget to ask your real estate agent these questions before listing your home!

#realestatereels #homeselling #homesellingtips #realestatetips #homesellingprocess #rmsma #JDSignatureRE #BKPlatinumProperties

1

Whether you have a patio, a deck, or just a small patch of grass in your backyard, these are the budget outdoor upgrade tips you need:

• Bring in vibrant colors with new seat cushions or planters.

• Go green by adding a few potted plants or faux grass if you don’t have a grassy space.

• Take the indoors outside by up…

1

Whether you have a patio, a deck, or just a small patch of grass in your backyard, these are the budget outdoor upgrade tips you need:

• Bring in vibrant colors with new seat cushions or planters.

• Go green by adding a few potted plants or faux grass if you don’t have a grassy space.

• Take the indoors outside by up…

12

1

You locked in a great interest rate — and that was smart.

But the real question is… does the house still fit your life?

For many homeowners, staying put means paying for space they don’t use, higher utilities, more maintenance, and more stress — even with a low rate.

Downsizing isn’t about giving something up.

It’s a…

12

1

You locked in a great interest rate — and that was smart.

But the real question is… does the house still fit your life?

For many homeowners, staying put means paying for space they don’t use, higher utilities, more maintenance, and more stress — even with a low rate.

Downsizing isn’t about giving something up.

It’s a…

1

February is the month of love, so it’s a great time to find the home of your dreams! Reach out when you’re ready to get your home search started.

#realestate #realestateagent #homebuying #homebuyer #homeownership #rmsma

#JDSignatureRE #BKPlatinumProperties

1

February is the month of love, so it’s a great time to find the home of your dreams! Reach out when you’re ready to get your home search started.

#realestate #realestateagent #homebuying #homebuyer #homeownership #rmsma

#JDSignatureRE #BKPlatinumProperties

1

🏠 Wondering what determines a home's true value? Zillow's Zestimates can be unreliable indicators of a property’s worth. Factors like location, size, condition, and market trends all play a crucial role. For a precise valuation, reach out today to get a professional assessment tailored to your home! 📈✨

#realestate #ho…

1

🏠 Wondering what determines a home's true value? Zillow's Zestimates can be unreliable indicators of a property’s worth. Factors like location, size, condition, and market trends all play a crucial role. For a precise valuation, reach out today to get a professional assessment tailored to your home! 📈✨

#realestate #ho…

jd_signature_real_estate

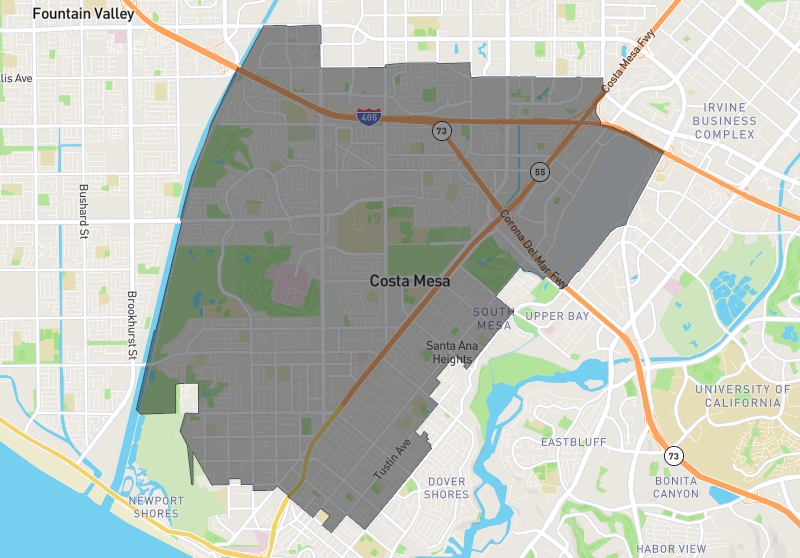

New Full Irvine, CA Market Update for Buyers and Sellers. Available now on my YouTube Channel! Link in Bio!!! Let me know what you think!!!

#jdsignaturere #bkplatinumproperties #ocrealtor #IrvineRealtor #irvine

jd_signature_real_estate

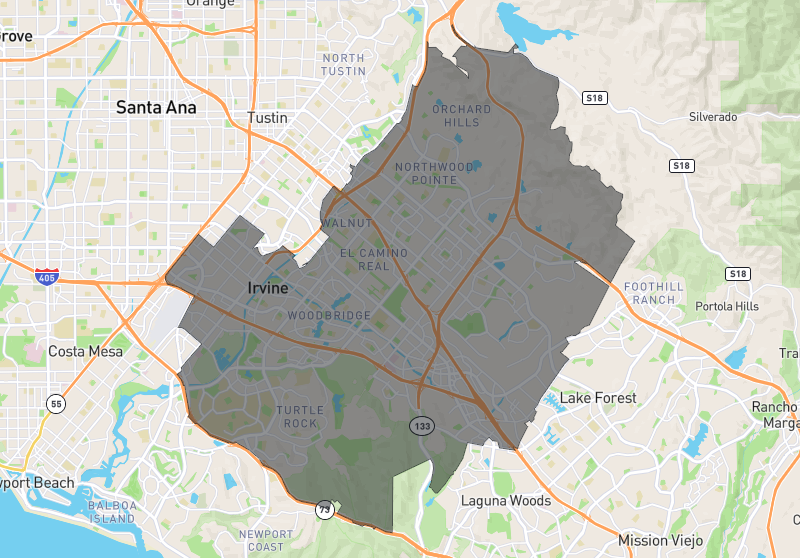

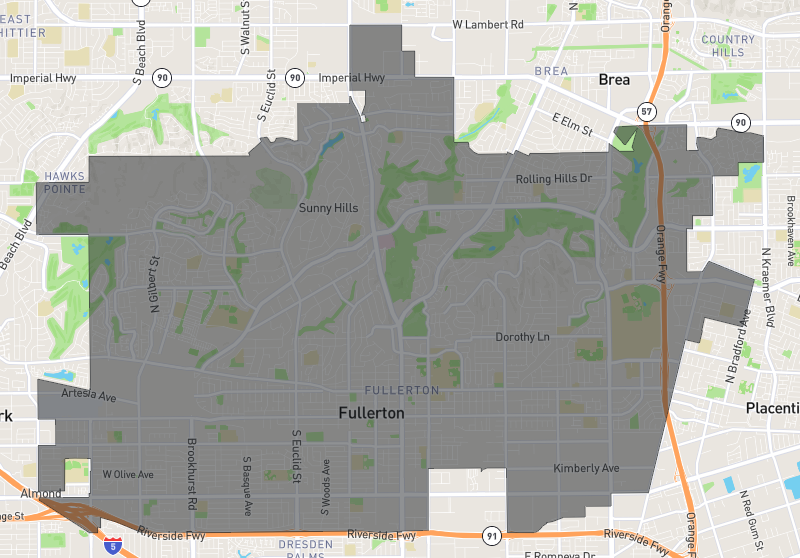

If you’re researching how much it really costs to buy a home in Irvine CA in 2026… the price is only part of the story.

Most buyers calculate the mortgage — but forget about:

• Property taxes (1.1%–1.35% in many neighborhoods)

• Mello-Roos in communities like Great Park & Portola Springs

• HOA fees that can range from $150 to $600+ per month

That’s how a $1.5M home can land closer to $9,500–$10,000 per month.

Irvine is still one of the strongest and most stable markets in Orange County — but smart buying here is about choosing the right neighborhood, not just the right house.

If you're searching:

“How much does it cost to live in Irvine?”

“HOA fees in Irvine neighborhoods?”

“Mello-Roos 2026?”

Comment “BREAKDOWN” or send me a DM and I’ll run the numbers for your price range.

#jdsignaturere #bkplatinumproperties #irvinerealtor #orangecountyrealestate #irvineca

jd_signature_real_estate

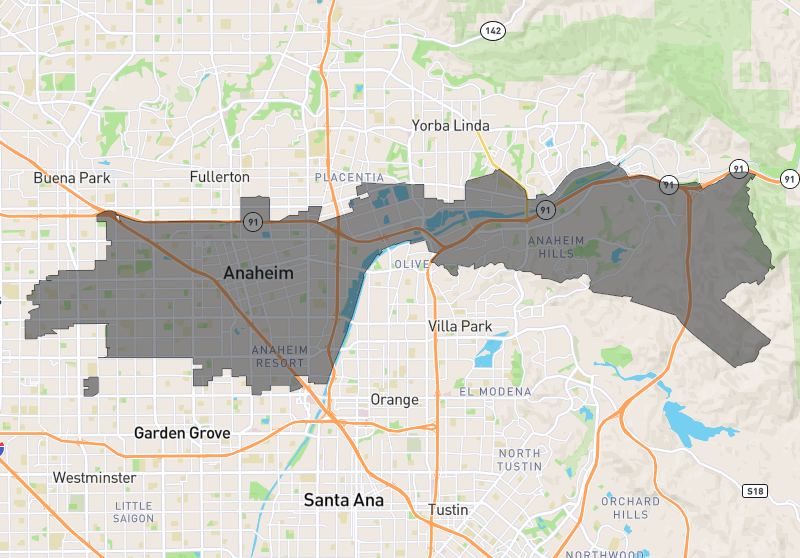

📊 Irvine real estate prices are up ~60% since 2021 — but most sellers are still leaving money on the table. Here's why.

The headlines say Irvine is booming. The data tells a more complicated story.

→ Median prices hit $1.55M in 2025 → 78.5% of listings cut their price before selling → Days on market jumped from 14 → 84 → Nearly 1 in 3 buyers paid all cash → Sellers who bought at the 2022–23 peak are losing $50K–$120K+

Swipe through all 10 slides to see the full picture — neighborhood by neighborhood, month by month, property type by property type.

If you're buying or selling in Irvine, the difference between winning and losing in this market comes down to strategy, timing, and knowing exactly what the data says before you list or make an offer.

That's exactly what I do for my clients every day.

🏡 James Deokar | JD Signature Real Estate Brokered by BK Platinum Properties

📅 Book your free consultation — link in bio. DM me "IRVINE" for the full market report, no strings attached.

--

#IrvineRealEstate #IrvineCARealEstate #IrvineHomes #IrvineHomesForSale #BuyingInIrvine #SellingInIrvine #IrvineHousing Market #SoCalRealEstate #OrangeCountyRealEstate #OrangeCountyHomes #LuxuryRealEstate #LuxuryHomes #RealEstateData #MarketReport #HomeSellingTips #HomeBuyingTips #RealEstateTips #RealEstateInvesting #IrvineAgent #IrvineRealtor #TopIrvineAgent #IrvinePropertyMarket #CaliforniaRealEstate #CARealEstate #JDSignatureRE #BKPlatinumProperties #JamesDeokar #RealEstateExpert #KnowBeforeYouBuy #KnowBeforeYouSell

jd_signature_real_estate

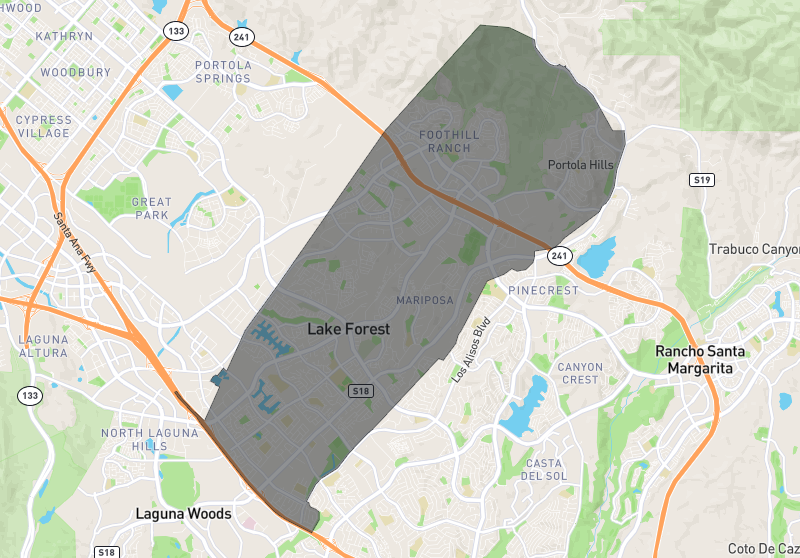

Irvine CA real estate update for 2026 👇

The market isn’t crashing.

Median prices are still in the mid-$1.5M range. Homes aren’t moving at 2021 speed, but if they’re priced right, they’re selling.

This is a strategy market.

If you’re buying in Irvine, selling in Irvine, or relocating to Irvine, California, you cannot rely on headlines. Pricing, negotiation, and positioning matter more than ever.

If you’re searching for a top Realtor in Irvine CA who knows the numbers by neighborhood — message me “IRVINE” and I’ll send you the data.

Serious buyers and sellers only.

#jdsignaturere

#bkplatinumproperties

#IrvineRealtor

#IrvineRealEstate

#OrangeCountyRealEstate

jd_signature_real_estate

Buying your first home in Irvine or Orange County doesn’t have to mean waiting years or overextending yourself.

For a lot of first-time buyers, townhomes are a smarter way to get into homeownership — lower prices, less maintenance, great locations, and the chance to start building equity instead of paying rent.

If you’re thinking about buying your first home and want to understand what’s actually realistic in today’s market, I’m happy to help.

📩 DM TOWNHOME and let’s talk through your options.

#jdsignaturere #bkplatinumproperties #IrvineRealtor #OrangeCountyRealtor #FirstTimeHomeBuyer

jd_signature_real_estate

The market is starting to shift in favor of buyers. More than one-third of sellers are now offering concessions, so if you've been waiting for a market correction, now could be the time to purchase your dream home! Reach out today to learn what options may be available!

#rmsma #realestestate #realestatemarket #sellersconcessions #buyersmarket #homenegotiations #JDSignatureRE #BKPlatinumProperties

jd_signature_real_estate

Buyers often form their first impression of a home based on the online listing, so professional photos are essential. While you may be equipped to tackle the task yourself, hiring an expert to take well-lit, high-quality images will ensure that you highlight your home’s best features to attract more potential buyers.

Let’s make sure your home stands out—send a message today to get started!

#realestate #realestateagent #sellertips #homeseller #selling #rmsma #JDSignatureRE #BKPlatinumProperties

jd_signature_real_estate

Don't forget to ask your real estate agent these questions before listing your home!

#realestatereels #homeselling #homesellingtips #realestatetips #homesellingprocess #rmsma #JDSignatureRE #BKPlatinumProperties

jd_signature_real_estate

Whether you have a patio, a deck, or just a small patch of grass in your backyard, these are the budget outdoor upgrade tips you need:

• Bring in vibrant colors with new seat cushions or planters.

• Go green by adding a few potted plants or faux grass if you don’t have a grassy space.

• Take the indoors outside by upcycling old indoor furniture into functional outdoor seating and storage.

• Paint your patio furniture with a fresh color or use painter’s tape to get crafty and add a pattern to an existing solid-colored outdoor rug.

• Find your focus by choosing a cohesive theme, like beach or country farmhouse. You’ll be more likely to use and enjoy an aesthetically pleasing outdoor area!

#outdoors #patio #deck #backyard #homeimprovement #rmsma #JDSignatureRE #BKPlatinumProperties

jd_signature_real_estate

You locked in a great interest rate — and that was smart.

But the real question is… does the house still fit your life?

For many homeowners, staying put means paying for space they don’t use, higher utilities, more maintenance, and more stress — even with a low rate.

Downsizing isn’t about giving something up.

It’s about lowering expenses, unlocking equity, and creating more freedom.

If you’ve even thought about selling or downsizing, DM me SELL and I’ll walk you through the numbers — no pressure, just clarity.

#jdsignaturere #bkplatinumproperties #orangecountyrealestate #homesellers #downsizing

jd_signature_real_estate

February is the month of love, so it’s a great time to find the home of your dreams! Reach out when you’re ready to get your home search started.

#realestate #realestateagent #homebuying #homebuyer #homeownership #rmsma

#JDSignatureRE #BKPlatinumProperties

jd_signature_real_estate

🏠 Wondering what determines a home's true value? Zillow's Zestimates can be unreliable indicators of a property’s worth. Factors like location, size, condition, and market trends all play a crucial role. For a precise valuation, reach out today to get a professional assessment tailored to your home! 📈✨

#realestate #homevalue #propertyvaluation #markettrends #rmsma #JDSignatureRE #BKPlatinumProperties